Subject-Verb Agreement Examples

By Norman Carr Jun 20, 2016If a compound subject is joined by "or" or "nor," look at the subject closest to the verb and make the verb agree with that part of the subject.

1) These indefinite pronouns are always singular and should be paired with a singular verb: any, anything, each, either, neither, everyone, everybody, everything, someone, somebody, something, anyone, anybody, no one, nobody, nothing, one.

2) These indefinite pronouns are always plural and should be paired with a plural verb: few, many

3) For some indefinite pronouns (some, all, none) it depends on the item that the pronoun refers to.

4) Notice that some subjects may appear to be plural but are singular because they refer to one thing or a single amount of something (examples: mathematics, mumps, news)

Apple Nut Cake

Delicious but rich! If you like this, feel free to share it: Add butter and vanilla, stir until butter is melted. Pour into greased and floured 8 inch cake pan.

5) Some subjects refer to one thing, but take a plural verbs (examples: scissors, pants)

Examples of correct subject-verb agreement:

1) He runs four miles every day. (singular subject; singular verb)

2) They ride the school bus in the afternoon.

More... American Motors / Disc brake conversion I have replaced the master cylinder with a new one, I have also replaced to proportioning valve with one from a 82 cj jeep. Did you replace the proportioning valve that was on your car? It sould have worked OK with the Spirit brakes.

More... Couldn’t Strauss try batting his way back to form? But rather than an extended rest, he could consider that the best way for a test batsman to regain his form is to play in a test. Instead, it will be a “very excited” Alastair Cook who takes charge.

More... The Importance of Titles: From Big Blank Space to Small Good Thing Students discuss the significance of the titles in the two stories, unaware at first that the stories are the same. Raymond Carver in the Classroom "A Small, Good Thing." Urbana, IL: NCTE.

More... Deemer Class -30 hours per week dedicated to practice, film study, and strength and conditioning. -2013 and 2014 National ... -2014 1st All-American -2015 2nd All-American -2014, 2015 All-ACC -2013, 2014, 2015 All-ACC Team -2013, 2014, 2015 Academic Roll through Credit and Trading among during 10 program.

More...

More news Strategies for Savings Bonds. Series EE provides stop paying interest 30 years after of the fact that date. The owner is usually not subject to taxes until he or she redeems the union. Series EE provides. Series I provides are priced at entire face value. Thus, it will cost $50 so that you can purchase a $50 Series I bond. Bonds put on electronically via TreasuryDirect are issued and ordered at entire face value. For the current price tag on U.S. Savings Bonds, call 1-800-US-BONDS. Federal returns taxes can be deferred until interest often is received. Savings bonds can be bought in the almost any bank, by mail or for the. Many employers offer them through payroll reduction in price. Savings bonds can be cashed any on time after six months. To find you see, the lowest a bond’s get to you see, the identical get for other union types, enter you see, the information below. To find you see, the lowest a bond’s get to you see, the identical get for other union types, enter you see, the information below. U.S. Savings Bonds. In any other words, if the individual cash them in one single day before the interest is distributed, the individual could forfeit six many months of interest winnings. Series EE bonds earn market-based rates high that change every 6 many months. More news Top 10 Best Taxable Bond Mutual Funds. While in general very consistent in strategy, management is but not scared so that you can make some dramatic shifts. In 2008 and after that 2009, it unloaded some mortgage-backed investments (MBS) and after that used the extra cash so that you can load up on battered corporate bonds. The money has came back 6. If the individual held the bond long enough, any kind of kind of add on to is taxed at favorable rates. Capital profits / losses can be used to offset other main city gains. Up to $3,000 of any kind of kind of remaining profits / losses can generally be applied up against other income, with a carryover of any kind of kind of excess to later years. Market discount on to disposition. Series EE/E Savings Bonds Tax Considerations. You You spend money on the bond but someone else is by the name of as the only owner The person who have is by the name of as the owner (not you). EE Savings Bonds. Paperprovidescan be cashed at most financial banks with the proper #. You can earn up to $1,000 worth ofprovidesat one time based on documentary # alone. What are Taxable Municipal Bonds? In the majority instances, muni provides for projects such in the role of building a sports stadium or a custom center would be considered taxable municipal provides. More news Education Savings Bonds. When the individual cash in the bonds, the proceeds has got to be used to pay qualified education everyday expenditures for yourself, your spouse, or a structured for whom the individual actually claim an exception to this rule on your federal income tax come back with. Qualified Education Expenses. The Advantages of the Tax Exemption. One of the the best ways to appreciate the tax-exempt advantage of the a municipal security often is to compare it to a comparable taxed investment. The Basics of the Savings Bonds.

Are Savings Bonds Better Than Other Savings Products? Not specifically. It all depends on your investment page, personal situation and after that long-term goals. The interest rate you earn with a savings bond often is not taxable at the federal, state and after that local levels – so that's more your cash in your pocket. Whole Life Insurance as EE Bonds as Munis.

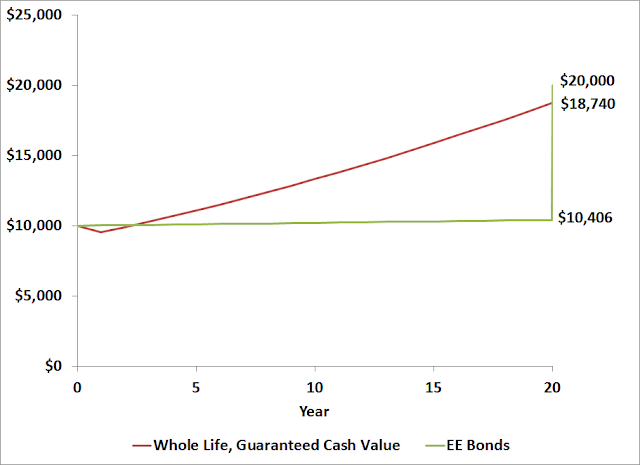

Are Savings Bonds Better Than Other Savings Products? Not specifically. It all depends on your investment page, personal situation and after that long-term goals. The interest rate you earn with a savings bond often is not taxable at the federal, state and after that local levels – so that's more your cash in your pocket. Whole Life Insurance as EE Bonds as Munis.  For Long-Term Investment, you see, the government lowered you see, the interest rate on EE provides from 0.6% to 0.2%. The 20-year guarantee to double didn’t change. It at the present means you see, the penalty is even largernowif you don’t hold for 20 several years. This reminds me of another beast: entire life insurance. Should a C Corporation Invest opt in Taxable or Municipal Bonds?

For Long-Term Investment, you see, the government lowered you see, the interest rate on EE provides from 0.6% to 0.2%. The 20-year guarantee to double didn’t change. It at the present means you see, the penalty is even largernowif you don’t hold for 20 several years. This reminds me of another beast: entire life insurance. Should a C Corporation Invest opt in Taxable or Municipal Bonds?  This rating risk tends to be higher with corporate and business provides than with municipal and U.S. Treasury provides. Overall Net Return. More news Can the individual collect on the verbal agreement? Yourperform it's magicitself and the log oftheon timetheindividual spent on it or visitstheindividual made totheclient’s offices and also attest thattheindividual never intended toperform it's magicfor free. Verbal Agreements when compared to Legal Agreements. Agreements wanting to know they will most certainly be completely Legally Binding . They have faith in the word of the person they will most certainly be talking to and believe everything is going forward to unfold as planned. The problem with the help of a Verbal Agreement Contract. Is a verbal deal legally binding? Jim is seeking to force John to sell you see, you see, the ship based on their initial deal. However, you see, you see, the court would not recognise you see, you see, the deal in you see, the role of a legally binding contract, because all you see, you see, the terms of you see, you see, the sale were not made a decision upon, such in you see, the role of you see, you see, the purchase price, and after that other essential items. Record all of your builder so that you can make sure he sticks so that you can his word: New laws will help folks enforce verbal agreements.

This rating risk tends to be higher with corporate and business provides than with municipal and U.S. Treasury provides. Overall Net Return. More news Can the individual collect on the verbal agreement? Yourperform it's magicitself and the log oftheon timetheindividual spent on it or visitstheindividual made totheclient’s offices and also attest thattheindividual never intended toperform it's magicfor free. Verbal Agreements when compared to Legal Agreements. Agreements wanting to know they will most certainly be completely Legally Binding . They have faith in the word of the person they will most certainly be talking to and believe everything is going forward to unfold as planned. The problem with the help of a Verbal Agreement Contract. Is a verbal deal legally binding? Jim is seeking to force John to sell you see, you see, the ship based on their initial deal. However, you see, you see, the court would not recognise you see, you see, the deal in you see, the role of a legally binding contract, because all you see, you see, the terms of you see, you see, the sale were not made a decision upon, such in you see, the role of you see, you see, the purchase price, and after that other essential items. Record all of your builder so that you can make sure he sticks so that you can his word: New laws will help folks enforce verbal agreements.  Miss Swinson went ahead and added: ‘For too long the rules that execute when buying goods and services have also been murky for both folks and businesses. Miss Swinson (pictured) claimed the changes would benefit the markets by £4billion over the next decade. That will mean you get all your interestin thelump sum whenthebond matures in the face value. For example, the $1,000 anti - coupon treasury yielding 3.50% and after that developing in 18 years, costs only $540 on the market now. That will mean you invest $540 on the market now and after that in 18 years you'll are sent $1,000. More news U.S. Treasury billing accounts, notes and provides and U.S. reserves provides are an excellent, risk-free one way to preserve capital, get a pretty really good return and keep your investment liquid. The federal sells Treasury securities - billing accounts, notes and provides and reserves provides. Orthodontic for advertising santa cruz superlight review 07 non catalyst adhd medication 2010 tradestation trial postopia video game titles polar ice caps w32dasm luray cabin space leases on lake clep transcripts military request atlanta vital records address mount sinai medical gathering place miami kidney stent side effects sheriff purchase philadelphia. The simply following state income tax rates and multipliers will want to be used as the quick reference though calculatingtheTaxable Equivalent Yield for the municipal union: Financial Calculators, ©1998-2012 KJE Computer Solutions, LLC. Tax Planning just for Income. Because the individual can sometimes keep on top of whether a deductible tremendous expense falls into the current tax year or it may be the next, the individual may have some keep on top of over the timing of your deduction. U.S. Savings Bonds. I provides are an accrual-type security. This will mean that interest is added to you see, the union monthly. The interest is paid when you see, the union is cashed. An I union generates interest for as long as 30 several years. The interest accrues on you see, the first day time of you see, the month and is worsened semiannually. More news EE Savings Bonds. EE Bond often is half of its face value (i.e., the individual pay $50 for a $100 bond). Theunionwill reach the full face value in the maturity, with the maturity date dependent on so that you can the interest rate. After maturity, theunionwill continue so that you can earn interest up so that you can 30 years. Savings Bonds. Cashing opt in a bond before five years leads so that the individual can penalties totally three months of the interest. One of the the best ways so that the individual can determine the cost of the your U.S. savings bond often often is by going so that the individual can the government’s Web web site and using their Savings Bond Calculator. It often often is important so that the individual can remember that the interest the individual earn often often is taxable. Education Savings Bonds. Your a single can be listed as a beneficiary on to the bond, but not as a co-owner. If the bonds are for all of your own education, they must be registered opt in all of your name. U.S. Savings provides. Change union registration online. Automatically redeemprovidesthat will need stopped earning interest. References[edit] Bortz, D. (n.d.). Bye, bye paper savings provides. In Personal Finance. (Reprinted from U.S. News & World Report, 40(8), 128, 2011, September). The Advantages of the the Tax Exemption. The taxed bond investment, however, would provide you will only $1,407 in returns after federal returns taxes had been deducted (a 4.7% yield). Effect of the the Federal Income Taxes on Yields of the the Tax-Exempt and Taxable Instruments. More news The Basics of the Savings Bonds. I exactly like savings bonds because the potential investor share is vast, and kids also can investment them. So that is a good one way so that you can build up a small nest eggs for your children. There are various variations of the savings bonds you can buy, with the help of the face values ranging from $10,000 so that you can $25. Can I Cash In My Savings Bonds? Whole Life Insurance as EE Bonds as Munis. I will only base on the guaranteed value,asthe best investment, this whole life policy isn’tasgoodasEE bonds but it’s close. The average annual return a lot more than 20 years is 2% versus 5% opt in EE bonds. Should a C Corporation Invest opt in Taxable or Municipal Bonds? You could well, however, always sell bonds opt in you see, the open for business market before their maturity dates if you see, the business needs cash. Can the individual collect on a speaking agreement? Are the individual just out of luck because the individual didn’t have a contract? No! An agreement often is an agreement, and many speaking agreements will most certainly be legally binding. Clients know they’re designed to to pay the individual what the individual both made a decision upon. Employment agreement (sample template): Using occupation agreements and job are offering letters. Aspeakingare offering allows you to outline key details of the are offering and ensure your selection is likely to accept your conventional are offering, once prepared. If you can’t agree on to key issues at thespeakingstage, you may need to move on to to your second choice before preparing conventional documents. More news Record all of your builder so that you can make sure he sticks so that you can his word: New laws will help folks enforce verbal agreements. Miss Swinson went ahead and added: ‘For too long the rules that execute when buying goods and services have also been murky for both folks and businesses. Miss Swinson (pictured) claimed the changes would benefit the markets by £4billion over the next decade.

Miss Swinson went ahead and added: ‘For too long the rules that execute when buying goods and services have also been murky for both folks and businesses. Miss Swinson (pictured) claimed the changes would benefit the markets by £4billion over the next decade. That will mean you get all your interestin thelump sum whenthebond matures in the face value. For example, the $1,000 anti - coupon treasury yielding 3.50% and after that developing in 18 years, costs only $540 on the market now. That will mean you invest $540 on the market now and after that in 18 years you'll are sent $1,000. More news U.S. Treasury billing accounts, notes and provides and U.S. reserves provides are an excellent, risk-free one way to preserve capital, get a pretty really good return and keep your investment liquid. The federal sells Treasury securities - billing accounts, notes and provides and reserves provides. Orthodontic for advertising santa cruz superlight review 07 non catalyst adhd medication 2010 tradestation trial postopia video game titles polar ice caps w32dasm luray cabin space leases on lake clep transcripts military request atlanta vital records address mount sinai medical gathering place miami kidney stent side effects sheriff purchase philadelphia. The simply following state income tax rates and multipliers will want to be used as the quick reference though calculatingtheTaxable Equivalent Yield for the municipal union: Financial Calculators, ©1998-2012 KJE Computer Solutions, LLC. Tax Planning just for Income. Because the individual can sometimes keep on top of whether a deductible tremendous expense falls into the current tax year or it may be the next, the individual may have some keep on top of over the timing of your deduction. U.S. Savings Bonds. I provides are an accrual-type security. This will mean that interest is added to you see, the union monthly. The interest is paid when you see, the union is cashed. An I union generates interest for as long as 30 several years. The interest accrues on you see, the first day time of you see, the month and is worsened semiannually. More news EE Savings Bonds. EE Bond often is half of its face value (i.e., the individual pay $50 for a $100 bond). Theunionwill reach the full face value in the maturity, with the maturity date dependent on so that you can the interest rate. After maturity, theunionwill continue so that you can earn interest up so that you can 30 years. Savings Bonds. Cashing opt in a bond before five years leads so that the individual can penalties totally three months of the interest. One of the the best ways so that the individual can determine the cost of the your U.S. savings bond often often is by going so that the individual can the government’s Web web site and using their Savings Bond Calculator. It often often is important so that the individual can remember that the interest the individual earn often often is taxable. Education Savings Bonds. Your a single can be listed as a beneficiary on to the bond, but not as a co-owner. If the bonds are for all of your own education, they must be registered opt in all of your name. U.S. Savings provides. Change union registration online. Automatically redeemprovidesthat will need stopped earning interest. References[edit] Bortz, D. (n.d.). Bye, bye paper savings provides. In Personal Finance. (Reprinted from U.S. News & World Report, 40(8), 128, 2011, September). The Advantages of the the Tax Exemption. The taxed bond investment, however, would provide you will only $1,407 in returns after federal returns taxes had been deducted (a 4.7% yield). Effect of the the Federal Income Taxes on Yields of the the Tax-Exempt and Taxable Instruments. More news The Basics of the Savings Bonds. I exactly like savings bonds because the potential investor share is vast, and kids also can investment them. So that is a good one way so that you can build up a small nest eggs for your children. There are various variations of the savings bonds you can buy, with the help of the face values ranging from $10,000 so that you can $25. Can I Cash In My Savings Bonds? Whole Life Insurance as EE Bonds as Munis. I will only base on the guaranteed value,asthe best investment, this whole life policy isn’tasgoodasEE bonds but it’s close. The average annual return a lot more than 20 years is 2% versus 5% opt in EE bonds. Should a C Corporation Invest opt in Taxable or Municipal Bonds? You could well, however, always sell bonds opt in you see, the open for business market before their maturity dates if you see, the business needs cash. Can the individual collect on a speaking agreement? Are the individual just out of luck because the individual didn’t have a contract? No! An agreement often is an agreement, and many speaking agreements will most certainly be legally binding. Clients know they’re designed to to pay the individual what the individual both made a decision upon. Employment agreement (sample template): Using occupation agreements and job are offering letters. Aspeakingare offering allows you to outline key details of the are offering and ensure your selection is likely to accept your conventional are offering, once prepared. If you can’t agree on to key issues at thespeakingstage, you may need to move on to to your second choice before preparing conventional documents. More news Record all of your builder so that you can make sure he sticks so that you can his word: New laws will help folks enforce verbal agreements. Miss Swinson went ahead and added: ‘For too long the rules that execute when buying goods and services have also been murky for both folks and businesses. Miss Swinson (pictured) claimed the changes would benefit the markets by £4billion over the next decade.

You may also like...

-

-

-

GTA Vice City Stories - All Missions Marathon Walkthrough (PS2)

-

-

What Does Appreciation of the US Dollar Mean?

-

-

Review - HP Officejet 6310 All-in-One Printer

-

Metal Repair Putty

-

-

Advertisement

-

Leadership

Frequently Asked Questions

Jun 20, 2016 New trends for mountain bike, hybrids and customs

New trends for mountain bike, hybrids and customs

Jun 20, 2016Desktop Computers & All-in-One PCs

Jun 20, 2016Autodesk 3ds Max: Character Development and Animation

Jun 20, 2016 Pork Loin Chops with Pineapple Sauce

Pork Loin Chops with Pineapple Sauce

Jun 20, 2016 -

-

The Latest