Oil steady but record U.S. stocks weigh on sentiment

By Norman Carr Feb 17, 2017

Analysts say the oil market is balanced between these twin pressures: OPEC cuts and rising USA inventories and production.

"However, if crude prices are to break out of their recent range in the next few weeks, the risk is to the downside". Eastern, off the settlement of $55.97 a barrel, which was up 38 cents but well off the session high of $56.46 a barrel.

USA natural gas futures fell to a three-month low on Thursday for March delivery on the New York Mercantile Exchange, and ended down 2.80% to $2.843 per million British thermal units.

Another difficulty facing market bulls is seasonal weakness, as refinery demand typically slows in January and February as refiners perform winter maintenance.

Late Wednesday morning, Brent crude was down 18 cents at $55.79 USA, after briefly turning positive.

A report by BMI research revealed that the compliance rate of 40 percent only by Iraq, OPEC Company's second largest producer could become problematic to the cohesion "group wise" as all the others are going beyond the targets to meet their overall set goals.

USA crude has been supported in a US$50 to US$55 a barrel range since late past year by the expectation of output cuts, but more evidence of market rebalancing is needed to maintain prices in this range, Tradition's McGillian said.

OPEC and other exporters including Russian Federation agreed past year to cut output by 1.8 million barrels per day (bpd) to reduce a price-sapping glut.

Chicago Bulls vs. Boston Celtics Takeaways: How Bout Dat?

Thomas said directly that it "cost us the game", adding that he was running off the court and "the Bulls were even shocked". With the chip firmly on their shoulder, look for another hard fought game from the Sixers in Boston tonight.

But "how much longer it takes for OPEC's cuts to show up in inventory data remains to be seen", he said. "The products will go down later", a third OPEC source said.

USA crude imports averaged 8.5 MMBPD, down 881,000 BPD from the previous week's average.

Kuwait is the latest nation to make headlines for announcing that it will boost, rather than cut, oil production once the Organization of the Petroleum Exporting Countries (OPEC) output reduction agreement expires in June.

Some traders said upcoming oil field maintenance across the Middle East might help the group achieve production cuts.

Talks of possibly extending the supply cut time frame come at time when the USA production is showing a strong revival.

Eleven non-OPEC countries, led by the world's largest oil producer, Russia, subsequently pledged to lower their production in concert by a combined 558,000 b/d.

"People got pretty close to the abyss and looked down, and it was pretty deep", the oil historian said in an interview with Bloomberg.

Most analysts believe prices will increase steadily now that OPEC has made a decision to cut production.

You may also like...

-

Nokia bets on nostalgia, set to re-launch iconic 3310

Nokia bets on nostalgia, set to re-launch iconic 3310

-

Arsène Wenger admits Arsenal 'mentally collapsed' during Bayern Munich rout

-

Did Adele Really Share Her Broken Grammy With Beyonce? Well, No

Did Adele Really Share Her Broken Grammy With Beyonce? Well, No

-

-

US National Security Advisor Michael Flynn resigns

-

Trump praises DeVos, pledges to expand school choice

-

Put pressure on for honest probe of Trump and Russia

Put pressure on for honest probe of Trump and Russia

-

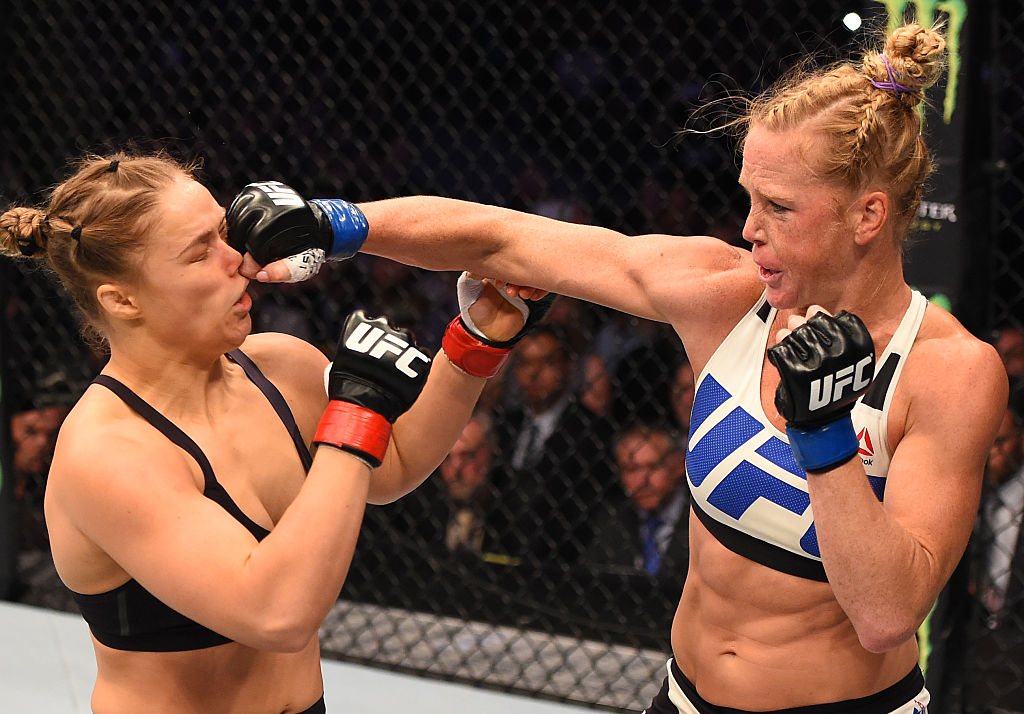

Dana White UFC 208 Post-Fight Interviews

Dana White UFC 208 Post-Fight Interviews

-

The Walking Dead Season 7 Finale to Have More Action than Ever

The Walking Dead Season 7 Finale to Have More Action than Ever

-

Advertisement

-

Leadership

PAUL RYAN: Obamacare repeal bill is coming next week

PAUL RYAN: Obamacare repeal bill is coming next week

Feb 17, 2017Arsene Wenger met with striker: He only moved last summer

Feb 17, 2017 What The NCAA's Longest Win Streak Looks Like

What The NCAA's Longest Win Streak Looks Like

Feb 16, 2017 Arsène Wenger insists Arsenal are up for the 'massive challenge' in Munich

Arsène Wenger insists Arsenal are up for the 'massive challenge' in Munich

Feb 15, 2017 Chinnamma defeated: SC convicts VK Sasikala, orders jail term of 4 years

Chinnamma defeated: SC convicts VK Sasikala, orders jail term of 4 years

Feb 14, 2017 -

-

The Latest

-

| Mar 23, 2017

Emirates, Etihad say not advised of new United States flight restrictions on electronics

-

| Mar 22, 2017

| Mar 22, 2017

-

| Mar 20, 2017

| Mar 20, 2017

-

| Mar 20, 2017

| Mar 20, 2017

-

| Mar 20, 2017

| Mar 20, 2017

-

| Mar 18, 2017

| Mar 18, 2017

-

| Mar 23, 2017

-

-

| February 09, 2017

| February 09, 2017

-

| February 03, 2017

Trump Admin Considering Plan To Target Immigrants Receiving Public Assistance

-

-

Top Tags

Copyright © 2017 voiceherald.com - Voice Herald | All Rights Reserved