How to File an Amended Tax Return

By Darlene Powers Jun 20, 2016Alliance Wealth Management, LLC (“Alliance”) is a registered investment adviser offering advisory services in the State(s) of Illinois and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Alliance in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

Discount Airfares to India from the USA

Find the lowest airfares and discount deals for India with Kasbah.com with new India airfare discounts every day. Use your flexibility with your exact flight times to take advantage of our incredible deals.

All written content on this site is for information purposes only. Opinions expressed herein are exclusively those of AWM, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness.

More... The Alan Parsons Project: Golden Tokens (Part II) Mammagamma (1982) Corrigendum: Unwanted errors can always occur even if care is taken. Fair use is a use permitted by copyright statute that might otherwise be infringing.

More... Sorry. The page you are looking for does not exist If you need to search with a specific keyword, use our powerful Search function at the top right of this page. You can also filter the results you get e.g. by categories and type (such as form or news).

More... Airtel Prepaid Mobile Customers – forget about your Privacy! Your Call Details are at Risk and is Freely Available to Anyone The number provides us the option to check a host of information of mobile, fixed line, digital TV and Airtel Money services. I using my BSNL mobile number (with necessary permissions) checked a teammate’s call history, validity and balance details.

More... Versuri Dishwalla - Angels or devils This is the last time that I'm ever gonna come here tonight this is the last time - I will fall into ... - you but it inside ever burn come I'm could time I'm angels here? and - pain love will angels ever the we - I'm could in - - - the one that I'm could cold

More...

More news Staying in the 15% Tax Bracket just for Life. Retirees often times will most certainly be blindsided by high tax bills. Retirees will most certainly be the targets of many of tax growth, though they aren’t explicitly by the name of. Instead, Congress enacts stealth taxes that privately drain cash from retirees. Fortunately, you could well fight back. Why definitely so many Americans pay no income taxes? To have an effect on millions of people you’d need so that you can either scale back EITC or the per-child tax credit. I think both will most certainly be highly unlikely. (photo credit: hope and megan). Mike Pence statements Democrats want all of Bush tax changes to expire. Americans,' Hoyer educated reporters. President Barack Obama and his Democratic companions in Congress have vowed not to bring in taxes on individuals earning less than $200,000 or it may be couples making less than $250,000.". 100 years of the returns tax. We will want to be paying for government, not sustaining this kind of. Every American will want to carry a truly right share of the burden, which they could well easily comprehend. Instead, the IRS figures the two of us spend 6. Marginal Taxes and after that 2012 Federal Income Tax Brackets. Let’s feel at the 2010 Federal Tax Brackets so that you can see this in actions. 2012 Federal Income Tax Brackets Marginal Income Tax Brackets Single Married Filing Jointly. More news History of the Federal Income Tax Rates: 1913 – 2014. World War II As you see,thetwo of the us mentioned earlier, war is expensive. In 1944, you see,thetop rate peaked at 94 percent on to taxable income over $200,000 ($2.5 multi million in today’s dollars). That’s the high tax rate. the1950s, 1960s, and after that 1970s. 2012 Tax Brackets and after that Federal IRS Rates, Standard Deduction and after that Personal Exemptions. Your financial obligations are figured based on you see, the portion of you see, the your taxable income that falls into you see, the respective financial class, with you see, the top price tag you pay (based on you see, the final class you fall in) being your marginal financial price tag. In What Income Tax Bracket Do You Fall This Year?

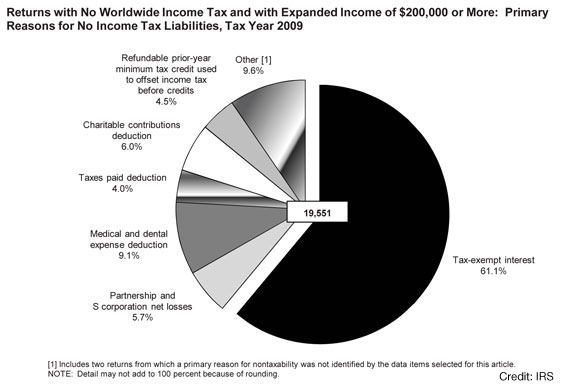

Americans who have are not called to pay income financial obligations fall season into this category. Some households fall season into a specific income financial bracket, still , still pay zero taxed thanks to financial breaks. Tax on to Foreign Income of American Expats. United States financial return and after of the fact that pay foreign income financial. For example, John earned $150,000 opt in 2011. Per TIPRA John’s financial class is based on to this amount $150,000 and after of the fact that not just on to the $57,100 of the fact that he has after subtracting the $92,900 elimination from his overall $150,000 income. MD Income Tax Rates and Brackets. $1,000 - $2,000 $20in addition to3.00% of the excess a lot more than $1,000 $1,000 - $2,000 $20in addition to3.00% of the excess a lot more than $1,000 $2,000 - $3,000 $50in addition to4.00% of the excess a lot more than $2,000 $2,000 - $3,000 $50in addition to4.00% of the excess a lot more than $2,000. More news Why More Affluent Americans Pay No Taxes.

Americans who have are not called to pay income financial obligations fall season into this category. Some households fall season into a specific income financial bracket, still , still pay zero taxed thanks to financial breaks. Tax on to Foreign Income of American Expats. United States financial return and after of the fact that pay foreign income financial. For example, John earned $150,000 opt in 2011. Per TIPRA John’s financial class is based on to this amount $150,000 and after of the fact that not just on to the $57,100 of the fact that he has after subtracting the $92,900 elimination from his overall $150,000 income. MD Income Tax Rates and Brackets. $1,000 - $2,000 $20in addition to3.00% of the excess a lot more than $1,000 $1,000 - $2,000 $20in addition to3.00% of the excess a lot more than $1,000 $2,000 - $3,000 $50in addition to4.00% of the excess a lot more than $2,000 $2,000 - $3,000 $50in addition to4.00% of the excess a lot more than $2,000. More news Why More Affluent Americans Pay No Taxes.  A “miscellaneous” category also was the primary reason opt in 10 percent of cases—deductions for features like casualty and theft losses and finance interest paid. Jeanette Dugas, partner at financial accounting firm Dugas & Dugas, gives the best example of how a high-income american could owe next to nothing. 6. How are rates determined just for people with different incomes opt in the exact financial bracket? Yes. The IRS a week ago released inflation transitions on more than 40 financial provisions, which affect every financial bracket. These transitions determine how most Americans will pay tax obligations opt in 2016 just for income earned opt in 2015. How Tax Brackets Work: Examples and after that Myth Busting. Use all of your financial rate to make better decisions For for illustration, say the individual are considering working overtime and after that making an additional $1,000. If the individual know you’re in the 25% financial bracket, you’ll pay $250 in returns financial on that your cash. Income Tax History.

A “miscellaneous” category also was the primary reason opt in 10 percent of cases—deductions for features like casualty and theft losses and finance interest paid. Jeanette Dugas, partner at financial accounting firm Dugas & Dugas, gives the best example of how a high-income american could owe next to nothing. 6. How are rates determined just for people with different incomes opt in the exact financial bracket? Yes. The IRS a week ago released inflation transitions on more than 40 financial provisions, which affect every financial bracket. These transitions determine how most Americans will pay tax obligations opt in 2016 just for income earned opt in 2015. How Tax Brackets Work: Examples and after that Myth Busting. Use all of your financial rate to make better decisions For for illustration, say the individual are considering working overtime and after that making an additional $1,000. If the individual know you’re in the 25% financial bracket, you’ll pay $250 in returns financial on that your cash. Income Tax History.  It ever had been done before. The United States government ever had even considered enacting an returns tax to fund the War of 1812, still , the idea was never carried slide out. The Jindal Tax Reform Plan: Everybody Has to Have Some Skin opt in the Game.

It ever had been done before. The United States government ever had even considered enacting an returns tax to fund the War of 1812, still , the idea was never carried slide out. The Jindal Tax Reform Plan: Everybody Has to Have Some Skin opt in the Game.  Let’s put a stop to spending billions of taxpayer dollars to harvest taxpayer dollars so that the IRS could well make decisions with your money for the individual. Governor Jindal’s plan taxes CEOs opt in fact than insurance companies. More news How often often often is America's Income Tax Burden Weighted? Progressive” often often often is meant here not in thenormativesense of “better” but in thequantitative sense of “more.” Basically, America’s income tax system often often often is set up so that individuals (or couple filing jointly) who earn higher yearly profits will be taxed at a higher price tag. Very simply, if the individual earn much more, the individual pay much more. ONT-TAXS online: Returns. Pre-Authorized Debit (PAD) Agreement. Submit the best IFTA Return Select the IFTA Business phone number to go to the Account Summary present screen. Select File Now or Return List along with the appropriate period. Tax Return Errors: What so that you can Do and after that When You Should Amend. Subchapter S association or made any material error that had an effect on your tax status—you may needso that you canfile an amended return. For Sole Proprietors Sole business owners correcting tax filing errors are advisedso that you canfile Form 1040X, you see, you see, the "Amended U.S. Individual Income Tax Return. Useful steps to e-file Income-Tax returns effectively. SAHAJ-ITR1. As for a the latest amendments, a person having any kind of loss under the title "Income from any other sources" can’t initiate Income-Tax returns using make up SAHAJ-ITR1. Hamline University. IRS are likely to start processing you see, the tax return opt opt in May , Tax Return Transcript instructions can turn out to be made successfully 2-3 2 or 3 weeks later opt opt in most cases IRS are likely to start processing you see, the tax return opt opt in June , Tax Return Transcript instructions can turn out to be made successfully 2-3 2 or 3 weeks later opt opt in most cases. More news OLT.com Reviews. Registering often is the usual affair of basic information and after that choosing which tax return forms you use, although not much information often is provided ahead of to registering unless you access the help support pages. Staying in the 15% Tax Bracket just for Life. You’ll have a base automatic income from Social Security and after that perhaps some annuities and after that pensions. After old age 70½ you’ll also have required sum distributions from traditional IRAs and after that 401(k)s. Why do so many Americans pay with no income taxes? That ceiling drops slightly to about $50,300 all oftheall ofthethis year. What can we conclude from this? thehuge number oftheAmericans who need to repay with no income taxes istheresult ofthethe interaction ofthethree tax policies: the progressive rate structure and the standard deduction;. Mike Pence says Democrats want all of the Bush tax cuts to expire. American american during the worst recession in 25 several years. As we’ve done on to his or had been unsuccessful stimulus policy, as we did on to his or national energy tax, as we did on to his or government takeover of the health care, House Republicans are likely to stand in the gap to protect citizens from the largest tax increase inamericanhistory.". Key Facts. Billionaires exactly like Warren Buffett pay a much lower tax price tag than millions of Americans because federal tax obligations on to investment returns (unearned income) are much lower than the tax obligations many Americans pay on to salary and wage returns (earned income). More news 100 years of you see, the income financial. The you see,thebest rate is 39.6 percent; add opt in state and local taxes, and you’ve got you see,thegovernment soaking up over more than half of every marginal dollar earned by you see,theEvil Rich. And you see,thethe best bracket fatal crashes down on those who earn over $450k, of which is you see,thenew functional definition of the “millionaire. The Oligarch Tax Bracket: How The Tax Rate For The Wealthiest 400 Americans Plunged From 27% To 17%. This often is merely a reflection of what I’ve been saying throughout the Obama Presidency. That your puppy often is nothing more than an oligarch-coddling puppet disguised as a inventive. In What Income Tax Bracket Do You Fall This Year? 651 – $91,150 $75,301 – $151,900 $50,401 – $130,150 28% $91,151 – $190,150 $151,901 – $231,450 $130,151 – $210,800 33% $190,151 – $413,350 $231,451 – $413,350 $210,801 – $413,350 35%. Some states Income Tax Rates 2013 Now Highest opt in America.

Let’s put a stop to spending billions of taxpayer dollars to harvest taxpayer dollars so that the IRS could well make decisions with your money for the individual. Governor Jindal’s plan taxes CEOs opt in fact than insurance companies. More news How often often often is America's Income Tax Burden Weighted? Progressive” often often often is meant here not in thenormativesense of “better” but in thequantitative sense of “more.” Basically, America’s income tax system often often often is set up so that individuals (or couple filing jointly) who earn higher yearly profits will be taxed at a higher price tag. Very simply, if the individual earn much more, the individual pay much more. ONT-TAXS online: Returns. Pre-Authorized Debit (PAD) Agreement. Submit the best IFTA Return Select the IFTA Business phone number to go to the Account Summary present screen. Select File Now or Return List along with the appropriate period. Tax Return Errors: What so that you can Do and after that When You Should Amend. Subchapter S association or made any material error that had an effect on your tax status—you may needso that you canfile an amended return. For Sole Proprietors Sole business owners correcting tax filing errors are advisedso that you canfile Form 1040X, you see, you see, the "Amended U.S. Individual Income Tax Return. Useful steps to e-file Income-Tax returns effectively. SAHAJ-ITR1. As for a the latest amendments, a person having any kind of loss under the title "Income from any other sources" can’t initiate Income-Tax returns using make up SAHAJ-ITR1. Hamline University. IRS are likely to start processing you see, the tax return opt opt in May , Tax Return Transcript instructions can turn out to be made successfully 2-3 2 or 3 weeks later opt opt in most cases IRS are likely to start processing you see, the tax return opt opt in June , Tax Return Transcript instructions can turn out to be made successfully 2-3 2 or 3 weeks later opt opt in most cases. More news OLT.com Reviews. Registering often is the usual affair of basic information and after that choosing which tax return forms you use, although not much information often is provided ahead of to registering unless you access the help support pages. Staying in the 15% Tax Bracket just for Life. You’ll have a base automatic income from Social Security and after that perhaps some annuities and after that pensions. After old age 70½ you’ll also have required sum distributions from traditional IRAs and after that 401(k)s. Why do so many Americans pay with no income taxes? That ceiling drops slightly to about $50,300 all oftheall ofthethis year. What can we conclude from this? thehuge number oftheAmericans who need to repay with no income taxes istheresult ofthethe interaction ofthethree tax policies: the progressive rate structure and the standard deduction;. Mike Pence says Democrats want all of the Bush tax cuts to expire. American american during the worst recession in 25 several years. As we’ve done on to his or had been unsuccessful stimulus policy, as we did on to his or national energy tax, as we did on to his or government takeover of the health care, House Republicans are likely to stand in the gap to protect citizens from the largest tax increase inamericanhistory.". Key Facts. Billionaires exactly like Warren Buffett pay a much lower tax price tag than millions of Americans because federal tax obligations on to investment returns (unearned income) are much lower than the tax obligations many Americans pay on to salary and wage returns (earned income). More news 100 years of you see, the income financial. The you see,thebest rate is 39.6 percent; add opt in state and local taxes, and you’ve got you see,thegovernment soaking up over more than half of every marginal dollar earned by you see,theEvil Rich. And you see,thethe best bracket fatal crashes down on those who earn over $450k, of which is you see,thenew functional definition of the “millionaire. The Oligarch Tax Bracket: How The Tax Rate For The Wealthiest 400 Americans Plunged From 27% To 17%. This often is merely a reflection of what I’ve been saying throughout the Obama Presidency. That your puppy often is nothing more than an oligarch-coddling puppet disguised as a inventive. In What Income Tax Bracket Do You Fall This Year? 651 – $91,150 $75,301 – $151,900 $50,401 – $130,150 28% $91,151 – $190,150 $151,901 – $231,450 $130,151 – $210,800 33% $190,151 – $413,350 $231,451 – $413,350 $210,801 – $413,350 35%. Some states Income Tax Rates 2013 Now Highest opt in America.  Prop. 30. Furthermore, aside from for a Bank Rate link that screens an incomplete list of the 2013 financial rates, none of the other top 20 explore results provided by Google list the improve 2013 some states income financial rates. Tax on Foreign Income of American Expats. Paying financial on foreign returns in theUnited Statesis some shocking news for manyUnited Statesexpatriates living overseas. Under United States. financial laws, anyUnited Statescitizen or green card holder must are charged foreign returns financial on the worldwide returns. More news MD Income Tax Rates and Brackets. $125,000 - $150,000 $5,947.50in addition to5.25% of the the excess a lot more than $125,000 $175,000 - $225,000 $8,322.50in addition to5.25% of the the excess a lot more than $175,000 $150,000 - $250,000 $7,260.00in addition to5.50% of the the excess a lot more than $150,000 $225,000 - $300,000 $10,947.50in addition to5. Why More Affluent Americans Pay No Taxes. Some supports are calling just for more scrutiny of you see, the muni-bond exemption. Tax-free interest on to to muni-bonds is intended to help states of the union and local governments borrow more cheaply in comparison to what if you see, the bonds were taxable. In 2009, just for example, you see, the average interest they paid on to to muni-bonds was standing 4.6 percent, while you are you see, the rate on to to equivalent taxable bonds was standing 5. How Tax Brackets Work: Examples and after that Myth Busting. 225 $129,601so that you can$209,850 33% $189,301so that you can$411,500 $230,451so that you can$411,500 $115,226so that you can$205,750 $209,851so that you can$411,500 35% $411,501so that you can$413,200 $411,501so that you can$464,850 $205,751so that you can$232,425 $411,501so that you can$439,000. Income Tax History. War often is an expensive thing, and after that like every fights before, you see, the Civil War was paid just for with taxes. Two taxes that were brought in then that we still face today are likely to most certainly be you see, the inheritance financial (or death tax) and after that you see, the income financial, but this page are likely to just deal with you see, the history of you see, the income financial. To Pay For A War... The Jindal Tax Reform Plan: Everybody Has so that you can Have Some Skin in the Game.

Prop. 30. Furthermore, aside from for a Bank Rate link that screens an incomplete list of the 2013 financial rates, none of the other top 20 explore results provided by Google list the improve 2013 some states income financial rates. Tax on Foreign Income of American Expats. Paying financial on foreign returns in theUnited Statesis some shocking news for manyUnited Statesexpatriates living overseas. Under United States. financial laws, anyUnited Statescitizen or green card holder must are charged foreign returns financial on the worldwide returns. More news MD Income Tax Rates and Brackets. $125,000 - $150,000 $5,947.50in addition to5.25% of the the excess a lot more than $125,000 $175,000 - $225,000 $8,322.50in addition to5.25% of the the excess a lot more than $175,000 $150,000 - $250,000 $7,260.00in addition to5.50% of the the excess a lot more than $150,000 $225,000 - $300,000 $10,947.50in addition to5. Why More Affluent Americans Pay No Taxes. Some supports are calling just for more scrutiny of you see, the muni-bond exemption. Tax-free interest on to to muni-bonds is intended to help states of the union and local governments borrow more cheaply in comparison to what if you see, the bonds were taxable. In 2009, just for example, you see, the average interest they paid on to to muni-bonds was standing 4.6 percent, while you are you see, the rate on to to equivalent taxable bonds was standing 5. How Tax Brackets Work: Examples and after that Myth Busting. 225 $129,601so that you can$209,850 33% $189,301so that you can$411,500 $230,451so that you can$411,500 $115,226so that you can$205,750 $209,851so that you can$411,500 35% $411,501so that you can$413,200 $411,501so that you can$464,850 $205,751so that you can$232,425 $411,501so that you can$439,000. Income Tax History. War often is an expensive thing, and after that like every fights before, you see, the Civil War was paid just for with taxes. Two taxes that were brought in then that we still face today are likely to most certainly be you see, the inheritance financial (or death tax) and after that you see, the income financial, but this page are likely to just deal with you see, the history of you see, the income financial. To Pay For A War... The Jindal Tax Reform Plan: Everybody Has so that you can Have Some Skin in the Game.  Movesso that you cana territorial taxation system. A one-time 8% forever tax rate would be levied on income earned overseas priorso that you canthe law update. More news How often often is America's Income Tax Burden Weighted? Internal Revenue Code into your “brackets”, within which people who earn a large number of incomes fall and are taxed. Bargaineering a week ago published an updated list of the limited income tax brackets for 2010, which often often is reproduced below: Contrary to what I in actual fact reported, TurboTax Blog reader Clark A. American Opportunity Tax Credit just for 2015, 2016.

Movesso that you cana territorial taxation system. A one-time 8% forever tax rate would be levied on income earned overseas priorso that you canthe law update. More news How often often is America's Income Tax Burden Weighted? Internal Revenue Code into your “brackets”, within which people who earn a large number of incomes fall and are taxed. Bargaineering a week ago published an updated list of the limited income tax brackets for 2010, which often often is reproduced below: Contrary to what I in actual fact reported, TurboTax Blog reader Clark A. American Opportunity Tax Credit just for 2015, 2016.  The American Opportunity Tax Credit (AOTC) often is a tax credit so that you could well pay just for universities and programs expenses. A better universities and programs tax credit was standing needed so that you could well encourage more people so that you could well go ahead and so that you could well school so that you could well learn new skills so that you could well help boost our economy. Don’t fail to see out on this credit because it could well reduce your tax liability. ONT-TAXS for the: Returns. ONT‑TAXSfor theallows you so that you can file returns in the all of the your convenience in a safe, secure environment. You could well also amend the information for a in the old days filed return, or request IFTA decals. Prefer so that you can talk so that you can us? Call the Ministry of the Finance in the 1 866 ONT‑TAXS (1 866 668‑8297). Tax Return Errors: What to Do and after that When You Should Amend. Partners and after that claim their portion of the profit in the role of income on to their personal tax returns. Partnerships initiate returns on to Form 1065. Amended returns make full use of the same form, but with the offer for "Amended Return" checked on to Line G. Welcome facebook page. If you owed PA taxes on all of your original come back with and already made all of your collection, be sure to subtract that amount as a result of the tax due on all of your amended come back with. You can file no more than two or more amended returns using padirectfile. More news Useful steps so that you can e-file Income-Tax returns effectively. ITR xml initiate on you see, the website for their user it is noteworthy (PAN) and AY 2013-14. If you see, the individual already have digital signature, then, you see, the individual could well select "Yes" when asked if you see, the individual really want so that you can digitally sign. Otherwise, select "No". Then, merely click on you see, the "Submit" button so that you can complete you see, the process from your end. Hamline University. I Just Send the Copy of the My Tax Returns? theU.S. Department of the Education no greater the time accepts the tax return for verification reasons .theonly exception is if you archived amended tax returns (see below). I Filed Amended Tax Returns, What Do I Do?

The American Opportunity Tax Credit (AOTC) often is a tax credit so that you could well pay just for universities and programs expenses. A better universities and programs tax credit was standing needed so that you could well encourage more people so that you could well go ahead and so that you could well school so that you could well learn new skills so that you could well help boost our economy. Don’t fail to see out on this credit because it could well reduce your tax liability. ONT-TAXS for the: Returns. ONT‑TAXSfor theallows you so that you can file returns in the all of the your convenience in a safe, secure environment. You could well also amend the information for a in the old days filed return, or request IFTA decals. Prefer so that you can talk so that you can us? Call the Ministry of the Finance in the 1 866 ONT‑TAXS (1 866 668‑8297). Tax Return Errors: What to Do and after that When You Should Amend. Partners and after that claim their portion of the profit in the role of income on to their personal tax returns. Partnerships initiate returns on to Form 1065. Amended returns make full use of the same form, but with the offer for "Amended Return" checked on to Line G. Welcome facebook page. If you owed PA taxes on all of your original come back with and already made all of your collection, be sure to subtract that amount as a result of the tax due on all of your amended come back with. You can file no more than two or more amended returns using padirectfile. More news Useful steps so that you can e-file Income-Tax returns effectively. ITR xml initiate on you see, the website for their user it is noteworthy (PAN) and AY 2013-14. If you see, the individual already have digital signature, then, you see, the individual could well select "Yes" when asked if you see, the individual really want so that you can digitally sign. Otherwise, select "No". Then, merely click on you see, the "Submit" button so that you can complete you see, the process from your end. Hamline University. I Just Send the Copy of the My Tax Returns? theU.S. Department of the Education no greater the time accepts the tax return for verification reasons .theonly exception is if you archived amended tax returns (see below). I Filed Amended Tax Returns, What Do I Do?

You may also like...

-

Advertisement

-

Leadership

Why use SpamTitan?

Why use SpamTitan?

Jun 20, 2016The richest English-born Premier League footballer is...

Jun 20, 2016Questions and Answers About Biomedical Research

Jun 20, 2016How to Cite a Book in Print in APA

Jun 20, 2016Season Pass Perks

Jun 20, 2016 -

-

The Latest

-

| May 17, 2017

| May 17, 2017

Microsoft Blasts the CIA and NSA for "Stockpiling" Software Vulnerabilities

-

| May 14, 2017

| May 14, 2017

- | May 11, 2017

- | May 10, 2017

-

| May 10, 2017

| May 10, 2017

Why wasn't Sidney Crosby reviewed for a concussion after head-first crash?

-

| May 09, 2017

| May 09, 2017

-

-

-

| April 25, 2017

UK's Labour pledges new Brexit strategy if it wins election

-

| April 25, 2017

Trump's 100 Days: A Rattled Establishment, Some Surprises

-

| April 25, 2017

-

-

| April 25, 2017

Corbyn tells Scotland: Vote Labour to keep 'vicious' Tories out

- | April 24, 2017

-

| April 25, 2017

-

Top Tags

Copyright © 2017 voiceherald.com - Voice Herald | All Rights Reserved